How Are Startups Really Valued?

The way we value startups isn't just a math problem — it's a window into how we see potential, risk, and ambition.

Reality shows may glamorize the early-stage pitch, but real valuation goes far beyond that. From gut-instinct pre-seed rounds to hard-nosed Series C negotiations, the journey is as layered and dynamic as the startups themselves.

🎧 Prefer to listen instead? Hit play below for the podcast version of this article — Episode 2 of our “Articles, by Vaarta Analytics” series.

Startup valuation is not just a number on a pitch deck. It is a reflection of belief, risk, potential, and timing. From early gut calls at the pre-seed stage to hard metrics by the time a company reaches Series C, how a startup is assessed changes as it matures.

This article explores what drives those changes. We break down how vision, data, investor psychology, and negotiation all play a role in shaping a company’s perceived worth at every stage.

Whether you are curious about how startup assessments work or looking to understand them more deeply, let us take a closer look at what really goes into deciding how much a startup is believed to be worth — and why it matters.

The Art, Science, and Psychology Behind Valuation

“Beauty is in the eye of the beholder.”

In the startup world, that beholder could be a founder, an investor, an early employee, or even the market itself. Each person sees potential differently, shaped by personal goals, appetite for risk, and what they stand to gain or lose.

For founders, a company’s estimated worth often feels deeply personal. It reflects late nights, hard decisions, and a deep belief in what they are building. They tend to see a future that has not yet shown up in financial models. That emotional connection can lead them to believe the company is more valuable than it might appear on paper. But unless that vision turns into something investors can evaluate and benchmark, it stays just that — a vision.

Investors approach the question from a different angle. Where founders see possibility, investors see risk. Most venture capital firms expect many of their bets to fail. To succeed overall, they depend on a few standout companies that deliver outsized returns. That is why early-stage pricing is not based on hope alone. It is a thoughtful bet on what the future might hold.

To guide these decisions, investors use a few well-established frameworks:

Discounted Cash Flow: Estimates how much money a company might earn in the future and calculates what that is worth today, accounting for uncertainty

Comparable Company Analysis: Compares the startup to similar businesses that have recently raised money or gone public

Venture Capital Method: Starts with a projected exit value and works backward to estimate today’s price

Berkus Method: Commonly used for startups with little or no revenue. This approach assigns rough dollar values to elements like the idea, team, and product development. The total typically tops out around two and a half million dollars

Scorecard and Risk Factor Methods: Adjust a base estimate based on market comparisons, team strength, and specific risks

Among these, the Berkus and Discounted Cash Flow models represent opposite ends of the spectrum. One leans on qualitative judgment. The other depends on financial forecasting.

This is why early-stage startup assessments are often more art than science. A compelling narrative, a large market, and a credible team can matter just as much as the numbers. Fundraising at this point becomes more of a conversation — where timing, trust, and belief can carry as much weight as spreadsheets.

As a company grows, performance starts to speak louder. Investors shift focus to concrete indicators, including:

Financial forecasts: Revenue growth, cash flow, and profit potential

Market size: Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM)

User traction: Growth in users, product engagement, and customer retention

Unit economics: Customer Lifetime Value (LTV) compared to Customer Acquisition Cost (CAC). A healthy ratio is typically three to one or better

Recurring revenue: Predictable income streams such as Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR)

Efficiency metrics: Indicators like Gross Merchandise Value (GMV), Net Revenue Retention (NRR), and other Key Performance Indicators (KPIs)

These metrics help investors compare startups more objectively. When the data is strong, it becomes easier for both sides to agree on how much the company is currently worth.

But even in later stages, the story still matters. The best outcomes happen when vision and performance work together. Founders who clearly communicate where they are going — and back it up with real results — tend to secure better terms.

A company’s valuation is not a trophy. It is a moment of alignment, a shared belief between those building the company and those investing in its future.

And what about employees?

If you are an early team member holding stock options, you may wonder what those shares are really worth. The answer depends on how the company is perceived in the market and what future investors are willing to pay. As that perceived value rises, so does the potential upside of your equity. But factors like dilution and future investment rounds also shape the final outcome.

🧾 It’s more than a number on your offer letter — it’s a long game of belief, risk, and payoff.

Stay tuned for our next blog: “What’s Really in Your Stock Options?”

How Valuation Evolves Across Funding Stages

A startup’s perceived worth is not static. It evolves with every stage — shaped by changing levels of risk, increasing traction, and shifting expectations from investors.

Early in the journey, investors lean on instinct. Later, they look for data. The balance between belief and proof keeps shifting as a company matures.

When there is little hard evidence, investors often say, “We are betting on the jockey, not the horse.”

At the start, it is less about what has been built and more about who is building it. As the business grows, performance begins to speak louder than potential.

Series A: Proving the Model

At this point, startups are expected to demonstrate product-market fit and an engine that works.Investors want to see:

Recurring revenue with early growth

Customer retention and engagement metrics

Strong unit economics — with a Lifetime Value to Customer Acquisition Cost ratio near or above 3 to 1

Gross margin stability

Operational discipline

Some investors now also ask for forward-looking profitability metrics like projected EBITDA — even if the business is not yet profitable — to assess fiscal awareness and potential margin leverage.

Valuation approaches at this stage include Discounted Cash Flow, the Venture Capital Method, and revenue comparable.

Pre-Seed and Seed: Betting on Belief

At this stage, most startups are pre-revenue or have just started gaining traction. The goal is to validate the idea, build a minimum viable product, and attract early users.

With limited data, investors look at:

Strength of the founding team

Clarity of the vision and domain knowledge

Quality of the prototype or proof of concept

Early signals of demand, such as waitlists or letters of intent

Valuation methods include:

The Berkus Method

Scorecard or Risk Factor Summation

Cost-to-duplicate (especially in tech-heavy products)

Target ownership method, where value is inferred from investment amount and equity stake

Founders often raise using flexible tools like SAFEs (Simple Agreements for Future Equity) or convertible notes. These allow for deferring the valuation discussion until a future priced round.

Series B: Scaling With Efficiency

Now the focus shifts from proving the model to scaling it with discipline.Investors expect:

Consistent growth in Monthly or Annual Recurring Revenue

Improving burn multiple (less cash burned per unit of revenue growth)

Shorter CAC payback periods

High Net Revenue Retention

Clear defensibility through technology, data, partnerships, or intellectual property

Pricing is often based on growth-adjusted revenue multiples, efficiency ratios, and projections of margin expansion.

Series C and Beyond: Optimizing for Exit

By Series C, investors expect a machine that runs smoothly. Capital is typically used for international expansion, new product lines, acquisitions, or IPO readiness.The focus now turns to:

Sustainable profitability (EBITDA and free cash flow)

Operating leverage and market share gains

Strategic positioning for exit

Valuation models rely more on public comparable, precedent transactions, and multi-year forecasting with higher confidence.

Why Investor Expectations Are Changing Faster

Today’s funding landscape is evolving fast. What used to be Series C metrics — like profitability or global expansion — are now expected as early as Series B. Series A rounds often demand what was once considered Series B-level traction.

Milestones are compressing. Investors are more selective. As a result, your pricing story needs to land earlier and hit harder.

The Power of Narrative: Outliers and Hype

While most companies move through this lifecycle in sequence, some leap ahead — driven by narrative strength, team pedigree, or market timing.

Clubhouse raised $100 million by Series B, hitting a $4 billion valuation within its first year.

Humane secured over $200 million before product launch, based solely on vision and founding team strength.

OpenAI bypassed traditional rounds with a $10 billion strategic partnership, redefining how frontier-stage bets are priced.

These cases are rare, but they underscore a deeper truth: performance matters — but so do timing, perception, and positioning.

A Helpful Analogy: Valuation as Career Growth

Startup valuation is a lot like career progression. Early on, your compensation is shaped by your role, background, and industry norms. Over time, it grows based on performance, reputation, and opportunity — either with your current company or by switching to a new one.

Similarly, a startup’s worth increases with traction, credibility, and investor belief. Whether with existing backers or new ones, it reflects a combination of what you’ve proven — and what others think you can become next.

Investor Perspectives on Valuation

Startup valuation is not just shaped by financial models. It is also defined by who sits across the table. Friends and family, angel investors, and venture capitalists all view value through different lenses — shaped by their experience, risk appetite, and return expectations.

Understanding what drives each type of investor helps founders align not just the price, but the entire fundraising strategy.

Friends and Family: Trust Over Terms

These are your earliest believers — backing the founder more than the financials.

Motivation: Emotional support, conviction in the person, and a desire to help.Typical instruments:

SAFEs (Simple Agreements for Future Equity)

Convertible notes, with or without caps

Common stock at nominal value

Even if informal, these deals should be properly documented to preserve trust and maintain a clean cap table for future rounds.

Angel Investors: Strategy with Flexibility

Angels are usually operators or founders themselves, investing personal capital and offering guidance.

Motivation: Return on investment, domain interest, and a chance to mentor.Valuation mindset:

Qualitative methods like the Berkus Method or Scorecard Model

Emphasis on founder strength, early traction, and market size

They move fast and are founder-friendly but still expect terms that won’t complicate future rounds.

Venture Capitalists: Scale, Structure, and Returns

Venture capitalists manage institutional funds. Their bets need to scale and deliver strong outcomes.

Motivation: Maximize returns at the fund level — through a few breakout wins.Valuation approach:

Structured models like Discounted Cash Flow, Venture Capital Method, or revenue multiples

Deep due diligence and a clear growth roadmap

Governance terms: board rights, liquidation preferences, anti-dilution protection

Early-stage firms may still invest on vision, but later rounds are almost entirely data-driven. Founders must be ready to defend the plan and the numbers.

What Makes a Valuation Fair?

Valuation is more than a number. It is a signal — to investors, employees, the market, and even to founders themselves. When aligned with progress, it builds confidence. When it runs ahead of reality, it creates friction.

What Shapes a Fair Price?

The risk and reward profile of the current stage

Proof of traction and market momentum

Investor return expectations

Broader market timing and sentiment

A higher valuation might help attract talent or gain visibility. But it also raises the stakes. If growth slows or goals are missed, pressure mounts. That can lead to down rounds, strained morale, or tough investor conversations.

Questions Founders Should Ask Before Closing a Round

Will this number still make sense a year from now?

Are we leaving room for natural growth in the next round?

Are we backing this number with real results — or just a good story?

Valuation is not the goal. It is a checkpoint on the path to building something meaningful.

And remember — trust matters just as much as capital. Investors back founders, not just spreadsheets. Keep them informed, stay transparent, and focus on building credibility round after round.

Because valuation is a snapshot. But your reputation is the full timeline.

When Valuation Becomes a Race

If strategy shapes how you set the number, emotion often drives why you chase it.

Let’s be honest. Sometimes it is not about how much capital you need. It is about not falling behind.

In today’s startup world, valuation often feels like validation. When a competitor raises more — even with similar traction — it can start to feel like you are the one slipping. It is easy to fall into the trap of chasing the number instead of focusing on what truly matters.

On Nikhil Kamath’s podcast featuring Carl Pei, Rahul Sharma, and Amit Khatri, this came up in a very real way. Rahul Sharma, co-founder of Micromax, shared how their entire approach had to shift once competitors entered the market with massive funding. It was no longer just about building — it became about surviving the capital game.

Amit Khatri, co-founder of Noise, added that in consumer brands, it can quickly become a race to the bottom. New players raise fast, spend faster, and burn out trying to stay visible.

So why do we chase the number?

Yes, sometimes we genuinely need the capital to grow. But sometimes, we just want to stay in the headlines. To look competitive. Or to avoid feeling like we are falling behind — even when we are actually on track.

Whatever your reason, raise with intention.

Keep your cap table clean. Stay grounded in why you started. Be clear about what you are building and who it is for. If you need to pivot, do it for the right reasons — not to validate the last round.

And one last thing: a good founder usually knows when things are shifting. The signs are always there. You just have to pay attention.

Final Takeaway

In the end, valuation is not the goal. Building something real is.

Markets change. Rounds come and go. But what stays is how clearly you tell your story, how consistently you deliver, and how deeply others believe in where you're headed.

That’s the signal that matters most.

In line with Vaarta Analytics’ ethos — let your data tell its story, with the synergy of clarity and conviction.

🚀 Whether you're a first-time founder, an operator holding equity, or someone simply curious about how venture-backed startups are priced — understanding valuation is key to navigating this world with confidence.

👂 Prefer listening? Follow our podcast on Spotify.

💡 And with AI reshaping how we analyze everything from cap tables to customer LTV, expect more on ESOPs and Strategic Investors next.

📝 Up next: “What’s Really in Your Stock Options?” — coming soon.

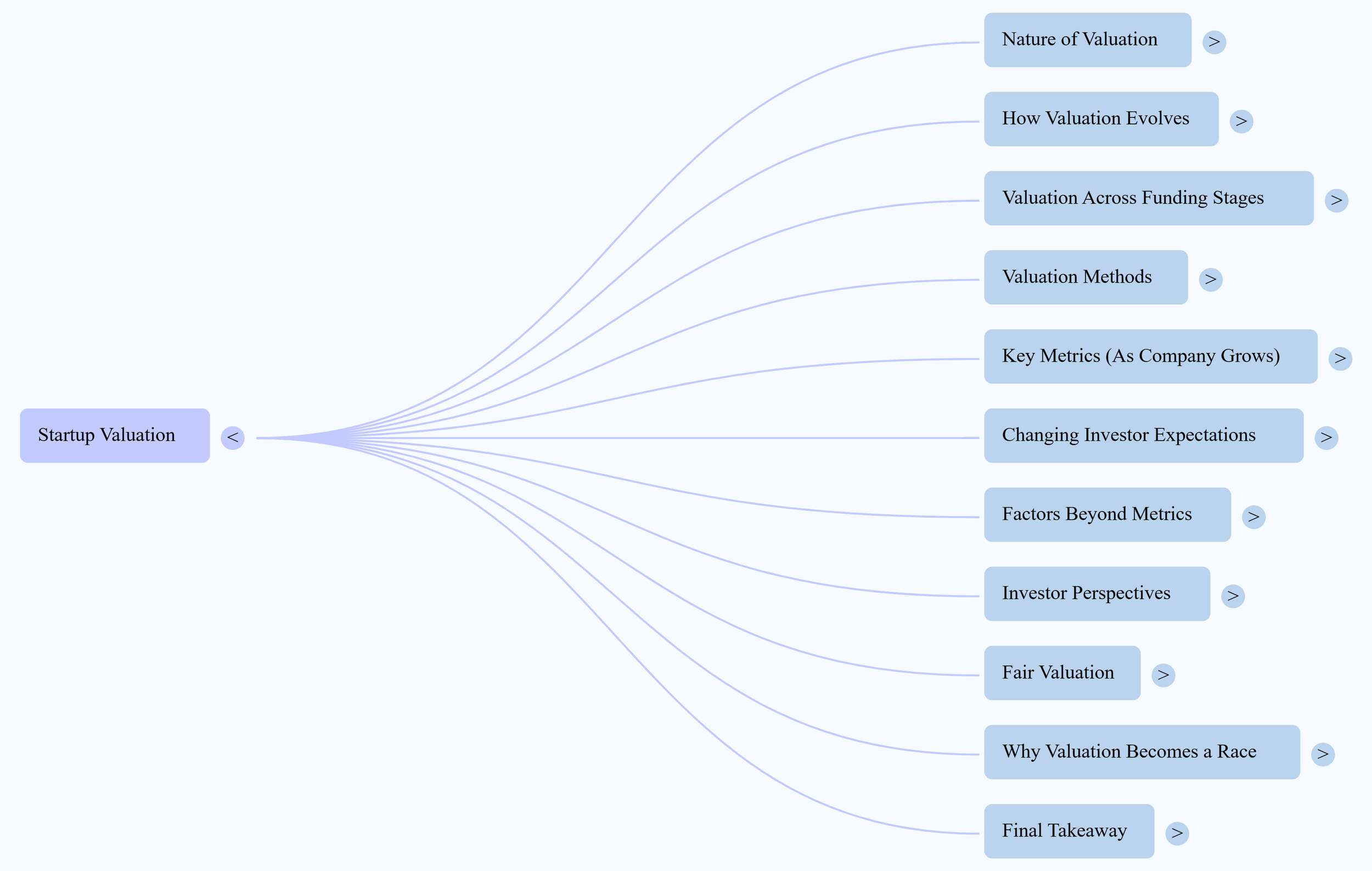

🧠 Visual Recap: Mind Map of This Article

A structured overview of everything we explored above — ideal for revisiting or sharing.

Why Teams Work with Vaarta Analytics

We help businesses unlock the full potential of their data through comprehensive BI, Data Science, and Engineering solutions.

Whether you're a startup or scaling team, our tailored analytics drive smarter decisions, sharper performance, and sustainable growth.

References for Further Exploration

"Venture Capital Valuation | VC Method" – WallStreetPrep

"The Discounted Cash Flow Method for Valuing a Startup" – Rho